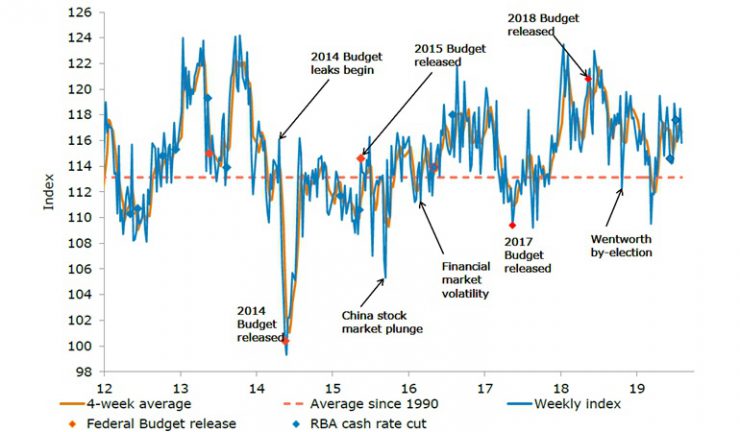

Dips after consecutive gains.

After two straight weekly gains, consumer confidence fell 2.3% dipped again last week with all sub-indices in the negative except ‘future economic conditions’, according to the latest Roy Morgan data.

Current financial conditions were down 4.3%, while future financial conditions fell 1.9%. Economic conditions were also mixed with current economic conditions taking a big hit of 6.1%, more than reversing the prior week’s big jump, while future economic conditions gained 3.8%. The ‘time to buy a major household item’ index also fell by 2.6%.

ANZ head of Australian Economics, David Plank, said renewed trade war tensions and the related equity weakness seemed to have negatively impacted consumer sentiment, with the drop over the past week driven by big falls in perceptions of current financial and economic conditions. However both remain comfortably above their long-term averages, most likely boosted by interest rate and tax cuts, he said.

“Weekly inflation expectations fell to 3.7%, the weakest result since the end of June and a disappointing print from the Reserve Bank perspective especially given the lift in headline inflation in the Q2 CPI.

“Inflation expectations can be volatile from week-to-week, so we need to get a few more readings before we can determine whether this is a renewed downtrend,” Plank said.